Economic and Market Update November 2025

The highlights:

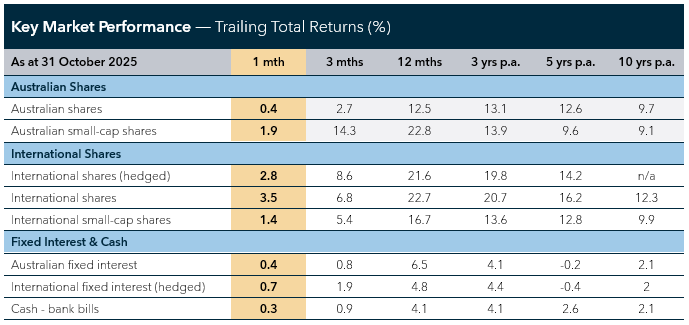

Global markets advanced in October as investors weighed renewed US–China trade tensions, a more cautious stance from the US Federal Reserve (Fed), concerns around US credit stress and elevated valuations. These factors were balanced against resilient corporate earnings and ongoing optimism around artificial intelligence (AI), which remains a key driver of the global growth narrative.

Australian shares edged higher but lagged their global peers as stronger-than-expected inflation data dimmed hopes for near-term Reserve Bank of Australia (RBA) rate cuts. A strong month from the miners and a steady one from the banks offset weakness in technology and consumer discretionary sectors. Smaller companies fared better, led by the materials sector as commodity prices advanced.

International shares rose, led by the US, where earnings and tech strength continued to drive risk appetite. Improving confidence in Asia and supportive policy signals from Japan added to the tone, helping markets extend gains despite lingering valuation concerns.

Fixed interest markets delivered modest gains, with yields fluctuating across regions as investors weighed shifting rate expectations and mixed economic signals. US Treasury yields eased, supported by the Fed’s decision to end its quantitative tightening programme, which improved market liquidity and reduced upward pressure on yields. In contrast, Australian government bond yields remained largely unchanged, leaving local bond returns to trail their global counterparts. Credit markets were supported by solid corporate earnings despite ongoing headlines around US credit stress, keeping investors selective.

Market observations

Is AI a Bubble?

Global equity valuations continue to rise, fuelled by strong enthusiasm for artificial intelligence (AI). While some question whether this momentum is sustainable, there are growing signs that the underlying technological shift is real and already reshaping parts of the economy.

The 2025 AI Index Report from Stanford’s Institute for Human-Centered Artificial Intelligence highlights remarkable progress — AI systems that could solve only a small fraction of coding problems in 2023 can now handle more than 70%. This leap reflects how quickly large language models are becoming capable of performing complex, real-world tasks, driving meaningful productivity gains across industries.

Recent research by Brynjolfsson, Chandar and Chen points to a subtle but important shift in labour markets. Early-career workers in occupations most exposed to automation — such as software development and administrative support — have seen weaker job growth, while less-exposed roles continue to expand. This emerging pattern of job softness, even as broader economic conditions remain solid, suggests that AI-driven automation is quietly reshaping workforce dynamics ahead of the cycle.

While disruption is inevitable, history offers perspective: technological revolutions often displace certain roles before creating new ones. AI may unsettle parts of the labour market in the short term, but its potential to enhance efficiency and productivity appears genuine. Enthusiasm may occasionally run ahead of fundamentals, yet the broader transformation underway appears both tangible and enduring.

US Government Shutdown

Markets have also turned their attention to the ongoing US government shutdown, which poses a short-term risk to growth if prolonged.

Historical data suggest that temporary shutdowns have only a modest impact, but costs can add up quickly. Current US Treasury estimates place the potential drag at around US$15 billion per week, or approximately 0.05% of GDP. Given the economy’s slower growth trajectory, an extended disruption could erode momentum heading into 2026.

While a brief shutdown is unlikely to have lasting economic consequences, a drawn-out impasse could dent confidence and delay spending decisions. Policymakers will need to resolve the standoff quickly to avoid undermining an otherwise resilient economy.

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.