Economic and Market Update December 2025

The highlights:

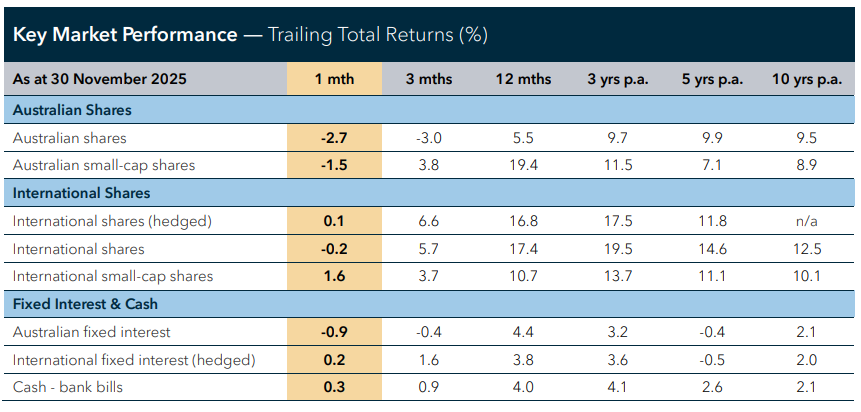

Global markets were broadly steady in November, with modest gains supported by shifting central bank signals and growing expectations of a December US Federal Reserve rate cut. Investors showed greater scrutiny of AI-related spending, although earnings remained resilient, and confidence was further lifted by solid performances across global property and infrastructure.

Australian shares declined over the month as stronger-than-expected economic data led markets to shift from expecting rate cuts to preparing for a possible rate rise in the year ahead. This shift weighed on several interest-sensitive areas, although some sectors held up comparatively well, with healthcare showing resilience and resource companies continuing to support the broader market.

International shares delivered modest but broadly positive results. US and European markets benefited from steady earnings and firmer economic indicators, while Asia presented a more mixed picture. Japan remained a standout, supported by improving domestic conditions and clearer policy direction, while China and emerging markets eased as softer sentiment weighed on investor appetite. Global small companies outperformed their larger counterparts.

Fixed interest markets were mixed. Global bonds showed signs of stability as more accommodative commentary from the US Federal Reserve supported the outlook for interest rate cuts. Global credit markets advanced as credit spreads narrowed amid resilient labour conditions and solid corporate fundamentals. In Australia, the 10-year government bond yield rose as markets priced out near-term rate cuts, weighing on local fixed interest rates

Market observations

Slow and Steady Wins

Global economic conditions continue to progress at a steady, measured pace, defying repeated predictions of an imminent downturn. Although delays in official US data have blurred the view, alternative labourmarket indicators suggest the economy is sturdier than many expect, with stress gauges and private-sector employment pointing to a mild easing rather than any significant weakening. Across major economies — the US, Europe, China and Japan — services activity remains in expansion, and consumer spending has held up despite ongoing uncertainty. Overall, the backdrop is neither booming nor faltering but quietly stable, with room for upside if confidence improves.

The New Gold Rush

Gold’s rapid rise has become one of the standout market stories of recent years. Since early 2020, prices have jumped more than 170%, far ahead of most major asset classes and raising understandable questions about how long the rally can continue. Much of this strength, however, appears to come from lasting forces rather than short-term speculation. Central banks have become major, steady buyers as they reduce reliance on the US dollar and look for protection from geopolitical tensions, fiscal concerns and the growing use of financial sanctions. Many emerging-market countries have been especially active, and investment flows into gold ETFs have picked up again after several years of outflows, adding renewed support. This rising demand meets a supply side that has struggled to keep pace. Gold mine output has plateaued after years of limited investment and increasing operational challenges, making it difficult to bring new supply to market quickly. Recycling — which often increases when prices rise — has only lifted slightly, leaving the overall supply of gold relatively tight. This imbalance has helped keep prices supported, even as occasional sharp pullbacks remind investors that gold can still be volatile. In this environment, interest in gold from some investors has become more visible, particularly as shares and bonds have at times moved more in tandem. These features mean gold is often discussed as a potential diversifier, with a history of mixed behaviour during recessions, inflationary periods and geopolitical stress. It is also an asset with clear limitations — it produces no income, experiences periods of volatility and does not suit all investment approaches. For these reasons, views on gold’s relevance vary widely, and its appeal ultimately depends on each investor’s circumstances, objectives and preferences. Our role is to remain aware of these evolving dynamics while ensuring portfolios continue to be positioned appropriately for their intended outcomes

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.