Economic and Market Update July 2025

The highlights:

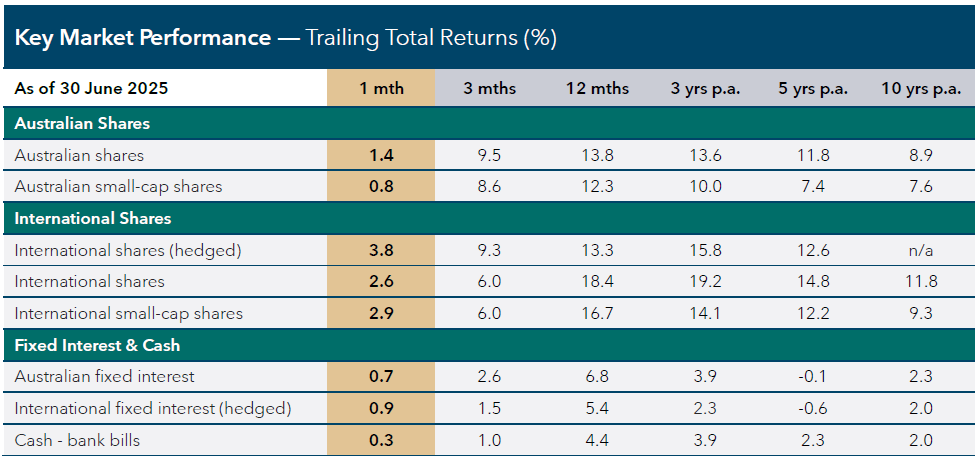

Global markets advanced in June, showing resilience despite ongoing geopolitical tensions in Ukraine, Israel, and Iran. The relative containment of these conflicts, along with delays to US tariff policies and a weaker US dollar, helped sustain investor confidence.

•Australian shares climbed to record highs, driven by investor optimism and rate cut expectations. The banks and growth sectors led gains, while defensives underperformed amid falling yields. However, with share prices rising faster than company earnings, concerns persist about whether current prices can be justified.

•International shares rallied, led by a strong performance in the US. Hopes for a “soft landing” — where inflation comes down without a recession — along with better earnings forecasts, boosted confidence in economically sensitive sectors. Still, high share prices in the US remain a concern, with valuation levels above long-term averages.

•Fixed interest markets posted modest gains, with early volatility giving way to greater stability. US Treasury yields moved within a narrow range, with political gridlock in the US helping to stabilise rate expectations. While short-term interest rate pressures eased, concerns over long-term government debt kept some caution in play. Credit (corporate bonds) markets performed well, supported by attractive yields and continued investor demand despite broader global uncertainties.

Market observations

Despite ongoing tensions in Ukraine, Israel, and Iran, global markets remained relatively calm in recent months. While these conflicts continue, they have had limited impact on overall market sentiment so far. We continue to monitor these developments closely and rely on diversification across our portfolios to help manage related risks.

In our view, the global economy is showing signs of slowing. This likely reflects the delayed impact of recent US trade tariffs. While earlier US economic figures were boosted by a surge in imports, more recent data gives a clearer picture. Activity across key economies — including the US, Europe, Japan and China — appears to be softening, especially in the services and retail sectors, where momentum has now stalled. However, labour markets remain resilient, with unemployment at multi-decade lows, helping to support household demand and reduce the risk of a more severe downturn.

Share markets have continued to climb, reaching multi-year highs. In the US, the S&P 500 has recovered from earlier concerns around company earnings and now trades at elevated valuation levels. Australian shares have also reached record highs, despite weaker earnings expectations. In our view, local market gains have been driven more by sentiment than fundamentals. Dividend yields have fallen to their lowest levels in 20 years, and growth remains subdued in key sectors, including banking and mining. Notably, bond yields have risen above dividend yields — a rare inversion that suggests investors are either unusually confident in shares or beginning to favour the income stability offered by bonds.

Bond markets have also stabilised. Concerns about corporate debt have eased, with credit spreads narrowing and investor appetite for high-yield bonds improving. Long-term US government bond yields have remained in a narrow range, helped by political resistance to large-scale spending plans. This has reinforced the view that more extreme fiscal measures may ultimately be tempered.

Although markets appear calm, we remain cautiously positioned, with equity valuations high and the economic outlook uncertain. A key risk we previously flagged was the potential for bond yields to rise — particularly if the Trump Administration’s proposed "Big Beautiful Bill" (BBB), which includes substantial tax cuts and increased government spending, were to pass in its current form. The recent passage of the BBB with only a minor reaction from bond markets has tempered our immediate concerns. However, trade uncertainty remains elevated despite the extension of the Trump Administration’s tariff negotiation deadline until 1 August. In this environment, we continue to favour a diversified, quality-focused approach and maintain our preference for Australian bonds, supported by the country’s relatively strong fiscal position. Patience and disciplined risk management remain central to our strategy.

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.