Economic and Market Update May 2025

The highlights:

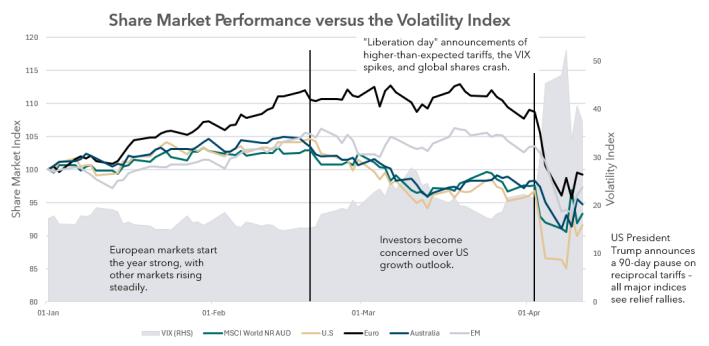

Global markets steadied in April, recovering from early volatility sparked by President Trump’s Liberation Day tariff plans, which were later paused for 90 days, easing investor concerns.

Australian shares rebounded, with the S&P/ASX 200 rising mid-month as optimism returned. Tech, communications, consumer discretionary, and real estate led gains amid improving confidence around global trade policy.

International shares delivered mixed results, with US markets rebounding late in the month on stronger earnings and the tariff pause. Europe gained on solid industrial data, while emerging markets lagged due to weak Chinese growth and currency volatility.

Fixed interest (bond) markets performed well, supported by safe-haven demand and signs that central banks are prepared to support the economy if needed.

Credit markets remained stable, with investment-grade debt firm and global high-yield bonds gaining as sentiment improved.

Market observations

Investor sentiment in early April was unsettled by President Trump’s Liberation Day tariff announcement on April 2, which proposed sweeping import tariffs set to take effect on July 4 — a symbolic move toward US economic “independence.” Markets reacted swiftly, anticipating the potential for higher inflation and weaker global trade.

Confusion initially reigned, as it remained unclear whether the tariffs would be enacted in full. Some investors clung to the notion of a “Trump Put”, expecting a policy reversal if markets fell too far. Others were more sceptical, highlighting the risk of stagflation from rising prices and slowing growth.

Infinity’s investment committee noted that traditional economic indicators, such as earnings and GDP forecasts, had yet to adjust, as the shock was too sudden and analysts awaited greater clarity. Meanwhile, survey-based “soft data” moved quickly, revealing sharp declines in consumer sentiment and rising inflation expectations. An unusual market dynamic emerged as US Treasury yields rose despite growing recession fears. Paired with a weakening US dollar, this raised questions about investor confidence in government debt management — concerns that faded as the month progressed. Relief came mid-April when Trump announced a 90- day pause on the tariffs, interpreted as a willingness to negotiate. Markets rebounded, as shown in the chart below, but in our view, the recovery may be premature. Hard data confirming a turnaround in growth has yet to emerge, while early signs of economic deterioration are only beginning to surface. We maintain a cautious stance on equities. The rally has lifted valuations to levels that assume a clear, robust growth path — an assumption not yet supported by current evidence. A measured, risk-aware approach remains appropriate until the outlook becomes more definitive.

Source: Evidentia/Bloomberg. Total return indices — Australia (S&P/ASX 300 TR), US (S&P 500), Europe (Euro Stoxx 50), EM (MSCI EM), MSCI World (MSCI World)

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.