Economic and Market Update June 2025

The highlights:

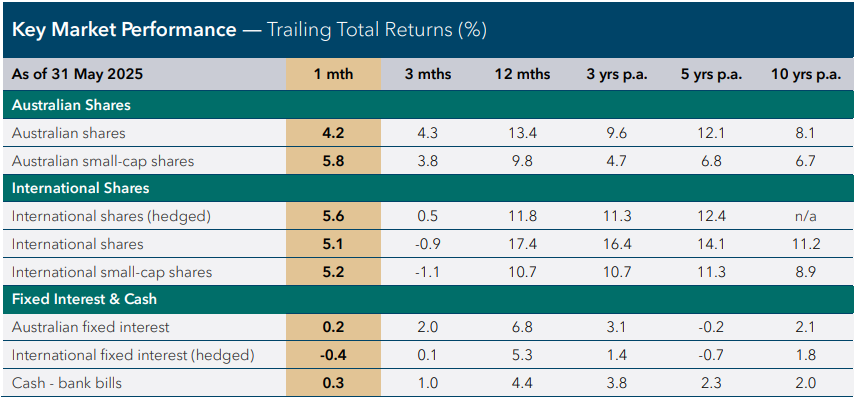

Global markets rebounded in May as optimism over the US administration’s willingness to negotiate on trade tariffs, followed by legal setbacks to the proposals, helped restore investor confidence. A weaker US dollar and resilient corporate earnings further supported gains across developed and emerging markets.

Australian shares advanced, led by strong gains in technology and energy sectors, while defensives such as utilities lagged. Risk appetite improved amid expectations of contained inflation and signs of easing global trade uncertainty.

International shares strengthened, particularly in the US where cyclical sectors like technology, industrials, and consumer discretionary outperformed. Investor sentiment was buoyed by favourable earnings revisions, reduced inflation concerns, and continued belief in a soft landing scenario.

Fixed interest (bond) markets declined modestly, as rising US Treasury yields — driven by fiscal uncertainty and mixed economic signals — weighed on bond returns across most developed markets. Concerns about long-term debt sustainability added to upward pressure on yields.

Credit markets remained broadly stable. Investment-grade bonds were supported by solid fundamentals, while high-yield sectors saw selective softness amid investor caution surrounding government deficits and the potential for lingering inflationary pressures.

Market observations

Markets staged a notable relief rally in May, driven by growing expectations of a policy reversal and easing concerns over escalating tariffs. This shift in sentiment was reinforced by significant legal developments concerning President Trump's "Liberation Day" tariffs, which had been a source of volatility since their announcement in April.

On May 28, the United States Court of International Trade ruled that President Trump's sweeping tariffs, including a 10% baseline duty on most imports and higher rates on goods from countries with significant trade surpluses, were illegal. The court determined that the administration had overstepped its authority under the International Emergency Economic Powers Act (IEEPA). This decision provided some relief to markets, although the administration's plans to appeal could prolong the uncertainty.

Equity markets responded positively to the court's ruling and signs of easing trade tensions. The S&P 500 index closed slightly above the 6,000 mark, prompting upward revisions to year-end targets from major investment banks. Analysts cited improved earnings outlooks and a weakening US dollar as key factors supporting expectations for further gains over the coming months.

US Treasury yields experienced volatility during the month. The 10-year yield averaged around 4.4%, reflecting investor uncertainty about the Federal Reserve's policy path and concerns over fiscal deficits. The US dollar continued to weaken, with the Dollar Index falling to levels not seen since 2023. This decline was attributed to trade policy uncertainties and their potential economic impacts.

While the equity market's rebound in May was encouraging, we maintain a cautious stance. The rally appears to be driven more by relief over legal developments and optimism about trade negotiations than by concrete improvements in economic fundamentals. Valuations have risen to levels that may not be sustainable without clear evidence of robust economic growth.

We continue to advocate for a measured, risk-aware investment approach, emphasising diversification and a focus on quality assets. Until there is greater clarity on trade policies and their likely economic outcomes, a patient stance remains justified.

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.