Economic Update August 2024

The highlights:

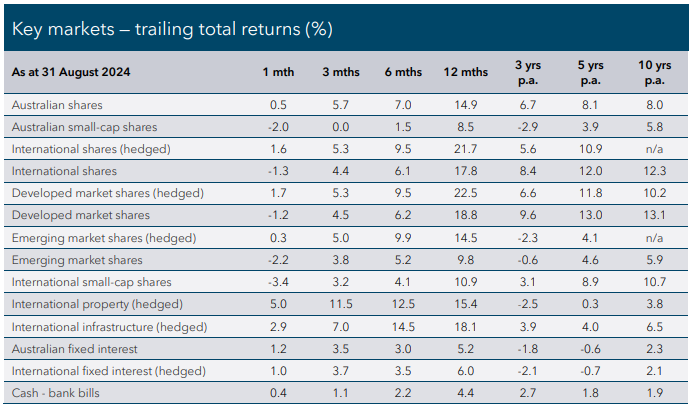

Recession fears, sparked by a weaker-than-expected US jobs report in July, led to significant market volatility in early August. However, investor sentiment quickly shifted positively as optimism grew the

US Federal Reserve would cut interest rates in September.

Shares and fixed interest (bond) markets experienced a V-shaped recovery after early falls to deliver solid gains in August, as investor concerns about a US economic slowdown were outweighed by the anticipation of imminent rate cuts which have traditionally been supportive for markets.

International shares continued to build on earlier gains, with investors gravitating toward defensive and interest rate-sensitive sectors. In contrast, Australian shares underperformed global markets due to a weaker-than-expected reporting season and increased uncertainty around the future direction of interest rates. Despite this, Australian shares still delivered positive returns.

Falling bond yields boosted returns for both global and Australian fixed interest markets, with government bonds and corporate bonds (credit) performing strongly.

Market observations

In early August, volatility returned to global share markets following weaker-than-expected US economic data, notably a jump in the unemployment rate. This sparked concerns about a potential slowdown in the world’s largest economy and prompted a shift by investors into the safety of government bonds. Although many expect the US Fed to begin cutting interest rates in September — a view later supported by Fed Chair Jerome Powell at the Jackson Hole Symposium — there were concerns relief might arrive too late to sustain the resilient US economy.

We viewed the market reaction as likely overblown, especially considering how elevated market valuations had become. While the uptick in unemployment warranted some caution, factors such as high immigration and lingering aftershocks from the pandemic could have distorted the data, suggesting the US economy was cooling rather than contracting. This was a view shared by economist Claudia Sahm, known for the Sahm Rule, which links sharp rises in the unemployment rate to potential recessions.

Following the early month sell-off, global share markets staged a quick V-shaped recovery as the initial concerns around the US jobs report subsided. By the end of the month, most markets had rebounded, nearing all-time highs. In contrast, bond yields, which initially fell, remained lower as inflation pressures continued to ease and the prospect of interest rate cuts grew closer. 10-year US and Australian government bond yields closed the month at 12-month lows, boosting returns for fixed interest markets as bond prices rose.

The chart below highlights the journey of global shares and cash rates throughout 2024. In August, recession fears initially weighed on markets, but a quick recovery in sentiment followed. However, this V-shaped rebound was short-lived, as renewed recession concerns emerged in early September, leading to declines in shares and bond yields.

Economic Review

Australia

At face value, the fight against inflation looked to have taken a big step forward, with annual core consumer price index (CPI) inflation — the Reserve Bank of Australia’s (RBA) preferred measure that excludes volatile items — in July slowing to 3.8% from 4.1% in June. However, some of that improvement has come from a range of government cost-of-living initiatives designed to provide relief for struggling Australian households, including rebates to artificially lower the cost of electricity.

Australia’s labour market continues to gradually ease. Unemployment rose to 4.2% in July, while wage growth for the June quarter was flat at 4.1%. The Australian economy grew by 0.2% over the June quarter — its eleventh consecutive quarter of growth — but fell short of forecasts and remained at the softest pace in five quarters.

As expected, the RBA left the cash rate unchanged at 4.35% at its early August meeting. Governor Michele Bullock made it clear that the RBA’s highest priority is to return inflation to target within a reasonable timeframe and suggested that rate cuts would be unlikely in the next six months. The RBA is not forecasting inflation to dip into its target 2-3% band until December 2025.

US

All eyes were on the labour market in early August as the unemployment rate ticked up to 4.3% in July, and fewer jobs were added than forecast. However, this was tempered by the August numbers released in early September, which had the unemployment rate dropping again to 4.2%, pointing to an orderly slowdown of the jobs market. Maintaining full employment is the important second objective of the Fed’s dual mandate — the first being to stabilise inflation at 2% — so the health of the labour market will be a key focus as the central bank weighs the timing and extent of potential rate cuts.

In positive news for markets and consumers, Fed Chair Jerome Powell signalled rate cuts will begin in September, in his Jackson Hole Symposium speech. By cutting rates, the Fed would reduce the cost of borrowing for goods and services, resulting in lower monthly payments for businesses and consumers, stimulating demand and hiring throughout the economy.

Europe

Lending further weight to a potential rate cut by the European Central Bank (ECB) in September, annual Eurostat flash estimate inflation fell to 2.2% in August, down from 2.6% in July. A decline in the costs of energy and industrial goods was a key contributor to the softest increase in consumer prices since mid2021.

Annual core CPI inflation in the UK eased to 3.3% in July from 3.5% in June. However, headline inflation edged up slightly, which is expected to happen over the next few months as sharp declines in energy prices in 2023 are included in the year-on-year calculations. Meanwhile, economic growth is estimated to have increased by 0.6% in the June quarter, following an increase of 0.7% in the previous quarter. Both data points will come into focus for the BoE — which cut rates by 0.25% to 5.0% in early August — when it meets to discuss monetary policy in late September.

Asia

Annual core CPI in Japan increased by 2.7% in July. This was in line with expectations and the strongest reading since the beginning of the year, lending some retrospective support to the Bank of Japan’s (BoJ) surprise rate hike decision in July, which triggered a rally in the yen. Japan's manufacturing sector stabilised in August, with output returning to growth and employment rising. June quarter economic expansion of 0.8% provided evidence of solid economic growth.

The People’s Bank of China (PBoC) left rates unchanged at 2.3% in August, injecting further cash into the economy to support China’s ailing property sector and stimulate investment and consumer demand. Investors also expect a near-term cut to the reserve requirement ratio — the portion of customers’ balances that commercial banks must hold as reserves — providing additional economic support.

Asset Class Review

Australian Shares

Recovering strongly following early month volatility, the Australian share market edged into positive territory in August, though it trailed most larger markets overseas. The S&P/ASX 200 Index ticked up +0.5%, recording its fourth consecutive month of gains. Repeating the theme from July, smaller companies struggled to maintain contact with their larger peers, retreating -2.0%.

Sector performance was mixed in August. This reflected a disappointing local earnings season in which 40% of companies provided earnings guidance that fell below market consensus, with uncertainty around interest rates and costs-of-living pressure creating a challenging backdrop. Information technology (+7.9%) defied the trend, leading the way thanks to positive earnings reports and upgrades for key names. Industrials (+3.9%) and communication services (+3.5%) also performed strongly. Consumer discretionary (-0.3%) retreated as continuing cost-of-living pressures impacted consumers. Meanwhile, the energy sector (-6.0%) was the worst performer as rising supply and weakening demand in China continued to drive oil prices lower. The materials (-1.9%) and utilities (-1.1%) sectors also underperformed, the former dragged lower by falling iron ore prices and the latter by lower long-term growth forecasts.

What fund managers are saying…

“The reporting season itself had very slightly more beats than misses, but it was really the outlook statements and guidance for the next year that drove share prices. Expectations for the 2025 financial year are that we are likely to see low single-digit growth in earnings for the whole market. With the whole market on around a 17 times price to earnings ratio, that puts it in the category of slightly higher than average multiples.

Interestingly, the banking sector is now more expensive than the overall market on average. With a flat to slight decline in earnings outlook, that makes it vulnerable if the other sectors perform. Resources, property and industrials all look like achieving about 5% earnings growth for FY2025, with resources the cheapest and industrials the most expensive.

With multiple political elections right around the world and interest rates at an inflection point, we are sure the fascination will continue into 2025.“

Fidelity International

International Shares

International share markets were mostly positive in August despite the volatility early in the month triggered by a weaker July US jobs report. The MSCI All Country World Index Hedged advanced +1.6%, but a stronger Australian dollar weighed on its unhedged equivalent index, which retreated -1.3%. In a reversal of last month’s rally, international small companies trailed their larger peers — the MSCI World ex Australia Small Cap Net Return AUD Index gave back -3.4%. Sector performance was robust. Interest-rate-sensitive real estate (+5.2%) led the pack, followed by health care (+4.6%) and defensive sector consumer staples (+4.4%). Growth sectors information technology (+1.2%) and communication services (+1.4%) recorded solid gains but underperformed as investors continued to rotate into interest rate-sensitive and more value-oriented sectors. Energy (-1.8%), which fell on weakening oil prices, and consumer discretionary (-0.1%), dragged lower by elevated interest rates impacting demand, were the worst performers for the month.

US shares continued to outperform. After dropping over 6% within the first three trading days, the S&P 500 Index recovered strongly throughout August, rising +2.4%. The tech-heavy Nasdaq Composite Index also performed well, gaining +0.9%, after experiencing significant volatility earlier in the month. The Euro Stoxx 50 Index advanced +1.8%, while the UK’s FTSE 100 Index was +0.9% higher. The unwinding of the carry trade triggered by the BoJ’s surprise rate hike continued to weigh on the performance of Japanese shares, with the Topix Total Return Index falling -2.9%. Emerging markets recorded another positive month — the MSCI Emerging Markets Index (Hedged) moved +0.3% higher — but lagged developed markets on weaker relative performances from index heavyweights China, India, and Taiwan.

What fund managers are saying…

“We believe it would be wrong to dismiss the early August market turbulence as akin to a toddler throwing a tantrum—much ado about nothing. As in almost all aspects of markets, price moves convey important information. The key insight we have gleaned from the turmoil is that excessive market positioning created vulnerabilities, which were exposed as perceptions about global growth shifted.

Accordingly, we believe investors must now be mindful that perceptions of economic activity, not inflation, will likely drive the coming phase of equity, fixed income, currency and commodity performance. The pace of growth should dictate how soon and how fast the US Federal Reserve, the European Central Bank and the Bank of England can cut interest rates, and whether the Bank of Japan will continue to tighten. It may also determine whether China finds the wherewithal to boost its flagging economy.

But mostly, perceptions about growth could direct what investors can expect in terms of future corporate profits, which would contribute to what valuations they are prepared to pay for those earnings. The ground has shifted. Investors should take note and heed the messages markets are sending.”

Franklin Templeton

Property and Infrastructure

Falling bond yields, imminent rate cuts in the US, and a stronger Australian dollar all combined to boost returns for interest-rate-sensitive asset classes global infrastructure and property. The property-focused FTSE EPRA Nareit Developed Index (Hedged) jumped an impressive +5.0% in August, its second consecutive month of strong returns, while the FTSE Global Core Infrastructure 50/50 (Hedged) Index also extended its recent gains, climbing +2.9%.

Fixed Interest

August was a positive yet volatile month for fixed interest markets. Initially, investors sought the safety of government bonds amid recession fears, driving yields sharply lower. However, yields soon rebounded before gradually falling again throughout the month as lingering concerns about the economic outlook led investors to anticipate more aggressive rate cuts. The 10-year US Treasury yield edged down -0.13% to 3.90%, while in Australia, the 10-year Australian Government Bond yield declined -0.15% to 3.97%. Declining government bond yields delivered solid returns for composite global and Australian bond indices, which government bonds dominate. The Bloomberg Global Aggregate Bond Hedged Index advanced +1.0%, while the local Bloomberg AusBond Composite 0+ Yr Index gained +1.2%.

The risk-averse sentiment that affected share markets did not carry over to credit markets (corporate bonds). Credit spreads — the extra compensation a corporate bond must pay above the so-called risk-free rate offered on a government bond with a similar maturity date — remained near the lower end of their historical ranges, which produced another month of solid gains for investment-grade credit, in line with returns from government bonds. Australian credit benchmark Bloomberg AusBond Credit 0+ Yr Index rose +0.9% in July, while global credit — as measured by the Bloomberg Global Aggregate Credit Total Return Index Hedged AUD — climbed +1.1%. Boosted by approaching rate cuts, global high yield credit also posted solid returns, with the Bloomberg Global High Yield Total Return Index Hedged AUD advancing +1.6%. .

What fund Managers are saying…

“Market volatility in early August highlighted the rapid shifts in sentiment in the post-pandemic era. This risk-off episode reaffirmed strategic advantage of bonds as a source of stability and diversification for risk asset exposures. Bonds rallied on expectations of central bank rate cuts, while equities weakened. A similar pattern was observed during the US regional banking crisis in 2023, which saw the largest daily drop in the US Treasury 2-year yield since 1982. Typically, the bond-equity correlation is negative when economic growth concerns outweigh inflation risks, allowing bonds to diversify equity exposures. Although the post-pandemic period was an exception, inflation is now under control, and growth risks have risen. The bond-equity correlation has recently returned to negative territory amid downside growth concerns, reinforcing the case for restoring, initiating, or increasing allocations to core fixed income assets, such as high-quality government and corporate bonds.”

Goldman Sachs Asset Management

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.